A loan expression could be the length of your loan, on condition that demanded least payments are created each month. The phrase in the loan can impact the composition on the loan in many ways.

Caret Down Bankrate shows two sets of price averages which can be generated from two surveys we perform: one particular day by day (“overnight averages”) and the opposite weekly (“Bankrate Check averages”).

Assuming the put together piggyback payment is lower than a single property finance loan payment with PMI, the borrower can borrow more money, meaning a costlier house.

At this time, a lot of homeowners have to start with mortgage rates below four%. In order that they’re deciding upon to open up a next mortgage loan as an alternative to a hard cash out refinance.

I’ve spent five years in composing and modifying roles, And that i now center on home finance loan, property finance loan aid, homebuying and home loan refinancing matters.

But when you’d desire paying out less in curiosity even when this means larger charges each and every month, a twenty-yr loan could do the trick.

This table would not include all providers or all accessible goods. Bankrate won't endorse or endorse any organizations.

We carefully point-Test and evaluate all articles for precision. We goal to generate corrections on any mistakes once we've been conscious of them.

The table below brings with each other a comprehensive nationwide survey of mortgage lenders to assist you to know very well what are by far the most competitive 20-12 months property finance loan costs. This table is up-to-date daily to provide you with the most existing curiosity costs and APRs when choosing a 20-yr preset home finance loan loan.

This funding choice is popular for lowering down payments and avoiding the need for PMI, resulting in lessen monthly payments.

Property prices are close to record highs. For those who don’t have plenty of with your piggy financial institution for your 20 % deposit, you will here be a applicant for your piggyback loan. Also known as an eighty/10/ten or blend home loan, it consists of obtaining two loans simultaneously to obtain a single property. The method can save you money. Right here’s what to be aware of.

I’m most interested in furnishing sources for aspiring initially-time homeowners to help demystify the homebuying approach. In 2021, I gained a Poynter ACES Certificate in Modifying. I've an MA in English.

In the event you’re buying a property as well as appraised price of the assets is lessen than the acquisition price, your LTV relies to the appraised value in its place. This could bring on a greater LTV ratio.

Last although not the very least, 2nd mortgages suggest far more financial debt, an increased mortgage payment, far more desire due, and might prolong the amount of time it takes to pay back your property.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Tatyana Ali Then & Now!

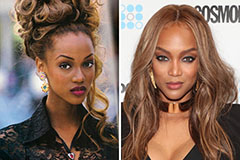

Tatyana Ali Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now!